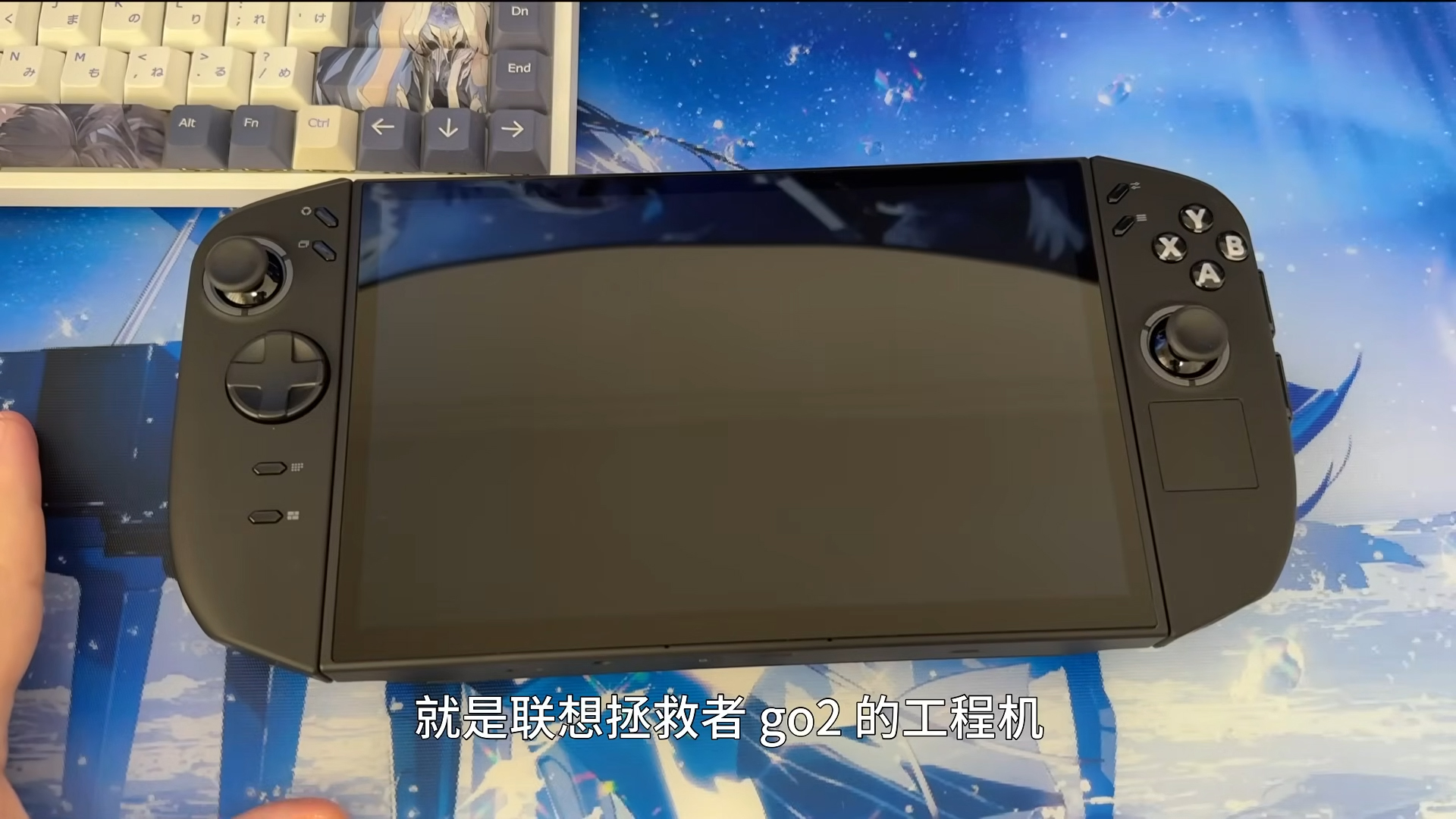

A prototype of Lenovo's next gaming handheld, the Legion Go 2, has been spotted in China. The device features a similar design to its predecessor, with detachable controllers and an 8.8-inch OLED display. It is powered by an AMD Ryzen Z2 processor and a 12-core Radeon 780M GPU. The Legion Go 2 is expected to come with 32GB of LPDDR5X memory, a 1TB PCIe Gen 4 SSD, and a 74Wh battery. It will also support Wi-Fi 6E, Windows 11, and have a game library integrator and on-screen stats. The price is rumored to be around $1,000, with a potential launch in September. Lenovo faces competition from Asus' ROG Xbox Ally and Ally X, which offer deeper Xbox integration and potentially more polished software.

Read full article

July 22, 2025 • By James Peckham

T-Mobile is rolling out a new low-latency technology called L4S to its 5G network. L4S, which stands for "Low Latency, Low Loss, Scalable Throughput," aims to reduce delays and choppiness during intensive tasks such as video calls and online gaming. The technology is designed to provide real-time responsiveness, even under heavy traffic. T-Mobile is the first US carrier to offer L4S, which has already been introduced in other countries like Germany and the UAE. The rollout has begun, but there is no clear roadmap or specific regions announced. Users won't need to upgrade their devices, as L4S will work automatically on current 5G smartphones. The technology has previously been used in wired services, such as Xfinity. T-Mobile's L4S rollout is expected to improve the experience for users engaging in performance-driven activities like cloud gaming, video calling, and Extended Reality (XR).

July 22, 2025 • By James Peckham

T-Mobile is rolling out a new low-latency technology called L4S to its 5G network. L4S, which stands for "Low Latency, Low Loss, Scalable Throughput," aims to reduce delays and choppiness during intensive tasks such as video calls, online gaming, and cloud gaming. The technology is designed to provide real-time responsiveness, even under heavy traffic. T-Mobile is the first US carrier to offer L4S, which has already been introduced in other countries like Germany and the UAE. The rollout has begun, but there is no clear roadmap or specific regions announced. Users won't need to upgrade their devices, as L4S will work automatically on current 5G smartphones. The technology has previously been used in wired services, such as Xfinity. With L4S, T-Mobile aims to improve the experience for users engaging in performance-driven activities where every millisecond matters.

July 22, 2025 • By Karthik Iyer

Amazon is offering a deal on AOC's 27-inch 240Hz QHD QD-OLED gaming monitor, dropping the price to $427.69, which is 18% off the usual price of $520. This is the lowest price tracked for this monitor, beating the previous low by $1. The monitor features a QD-OLED panel, 240Hz refresh rate, and 0.03ms response time, making it suitable for gaming. It also has G-Sync compatibility and covers 147.6% sRGB and 110.2% DCI-P3 color space for vibrant visuals. The monitor has a sturdy base with adjustable settings and multiple ports, including DisplayPort 1.4 and HDMI 2.0.

July 22, 2025 • By Makalah Wright

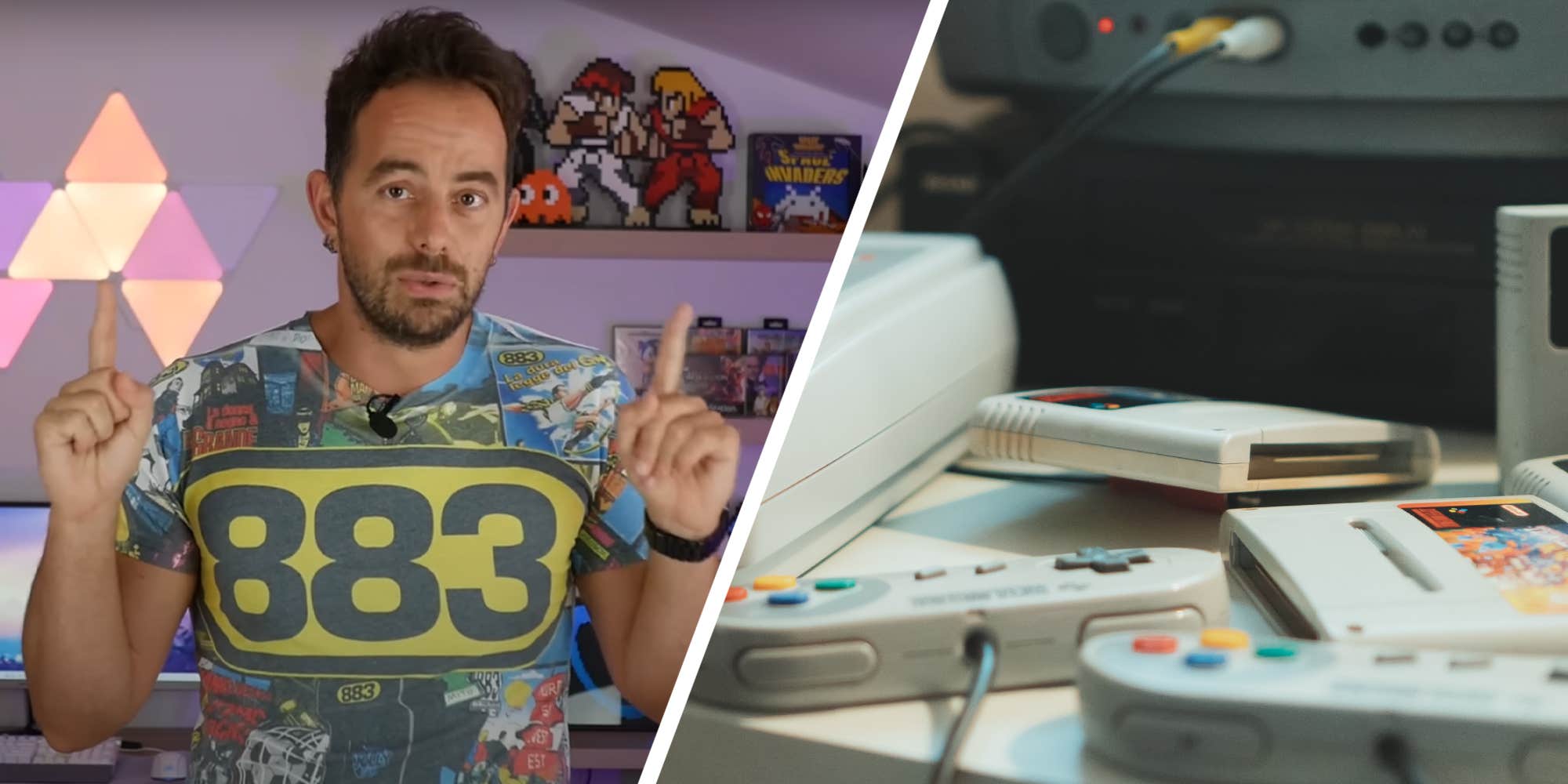

An Italian YouTuber, Francesco Salicini, had his home raided and 30 retro game consoles seized by the Guardia di Finanza. He is being investigated for allegedly violating Italian Copyright Law by reviewing Android-powered handheld gaming devices with pre-loaded old games. Salicini may face up to three years in prison and a fine. The incident has sparked confusion and debate online, with some users questioning the fairness of the arrest and others explaining the complexities of copyright laws surrounding retro game consoles. Salicini has started a GoFundMe page to help with legal fees and is awaiting trial. The case highlights the importance of being aware of copyright laws when purchasing or reviewing retro game consoles, and the need to buy from original manufacturers or trustworthy retailers to avoid potential legal issues.

July 22, 2025 • By MarketBeat News

Envestnet Asset Management Inc. increased its holdings in Logitech International S.A. by 8.9% in the first quarter, now owning 109,716 shares worth $9,261,000. Other institutional investors, such as Wealth Enhancement Advisory Services LLC and Freedom Investment Management Inc., also raised their stakes in the company. Logitech International has a market capitalization of $15.14 billion and a dividend yield of 1.4%. The company has been the subject of several research reports, with analysts giving it an average rating of "Hold" and a price target of $91.29. Logitech International designs and manufactures software-enabled hardware solutions, including products for gamers, streamers, and video conferencing.

July 22, 2025 • By Miguel Ty

The Samsung Odyssey G9 (G91F) is a 49-inch Dual QHD 144Hz curved gaming monitor that offers an immersive experience with great visuals. It features a VA panel with a 5120×1440 resolution, covering 95% of the DCI-P3 color gamut, and has a peak brightness of 600 nits with native HDR10 support. The monitor has a 1000R curve, which matches the natural curve of the human eye, and a professional design with a versatile stand that offers height, tilt, and swivel adjustments. It also supports Picture-by-Picture and Picture-in-Picture modes, making it ideal for multitaskers, streamers, and editors. The monitor has a 144Hz refresh rate, 1ms response time, and AMD FreeSync Premium Pro, making it suitable for fast-paced gaming. However, it lacks USB-C with Power Delivery and true HDR1000 performance. The monitor is priced at PHP 65,999 (around USD 1,171) and is currently on sale for PHP 56,099.15 (around USD 995). Overall, the Samsung Odyssey G9 is a unique and stunning centerpiece that elevates any setup, making it perfect for gaming, multitasking, and media consumption.

July 22, 2025 • By Karthik Iyer

A video on YouTube showcases Lenovo's Legion Go 2 PC gaming handheld, featuring an OLED display and detachable controllers. The device also has VRR support, which may affect battery life due to increased power consumption. The Legion Go 2's specifications are compared to the upcoming Xbox ROG Ally X handheld, with the latter potentially being more powerful. However, the Legion Go 2's OLED panel and versatility features, such as a trackpad and built-in kickstand, may attract attention. The price of the Legion Go 2 is unknown, but it may be expensive due to the OLED panel with VRR.

July 22, 2025 • By Justin Kahn

Amazon has put its current-generation Fire TV Stick streaming devices on sale, with discounts of up to 40% off. The deals aren't as low as Prime Day offers, but are similar to the best prices tracked this year. The Fire TV Stick 4K models are within $5 of their Prime Day prices, while the entry-level model and Cube are also discounted, although not as deeply as during Prime Day. These prices offer a notable chance to pick up a device at a savings of up to 40% and are a affordable way to add streaming capabilities to any display with a USB-C port.

July 22, 2025 • By amelia.schwanke@futurenet.com (Amelia Schwanke) , Amelia Schwanke

Disney is reportedly testing Runway AI's generative AI tools for potential use in movies and TV shows, following in the footsteps of Netflix, which has already used the technology in its original production, "The Eternaut". The AI tool has the potential to significantly reduce production time and costs, with Netflix's co-CEO Ted Sarandos stating that a VFX sequence was completed 10 times faster using the technology. Other studios, such as Lionsgate and AMC Networks, have also partnered with Runway AI to utilize its tools. The use of AI in the entertainment industry has raised concerns about the potential impact on jobs and creative integrity, but it appears that more studios are becoming comfortable with the technology. Runway AI is also exploring its use in the gaming industry with a new text-to-video game AI generator.

July 22, 2025 • By Isaiah Williams

A prototype of Lenovo's upcoming handheld gaming PC, the Legion Go 2, has leaked in China, with units available for purchase on a second-hand platform. The leaked units feature an AMD Ryzen Z2 processor, rather than the previously announced Ryzen Z2 Extreme. The device boasts an 8.8-inch OLED PureSight touch display, which may justify a potential $1,000 price tag. However, the author notes that a price point above $1,000 may be unappealing, and recommends a price below $900 to make it a more competitive option against devices like the Steam Deck OLED and Nintendo Switch 2. The official launch is expected to be in September 2025, but Lenovo has not provided further details on the device's specifications or pricing.

July 22, 2025 • By MarketBeat News

Here is a concise summary of the news article: New York State Common Retirement Fund reduced its stake in GameStop Corp. (NYSE:GME) by 3.9% in the first quarter, owning 196,378 shares worth $4,383,000. Other institutional investors, including Mitsubishi UFJ Asset Management Co. Ltd., Bessemer Group Inc., and Nomura Asset Management Co. Ltd., increased their holdings in GameStop during the 4th quarter. GameStop reported $0.17 earnings per share for the quarter, topping analysts' estimates, with revenue of $732.40 million. Analysts anticipate the company will post 0.08 EPS for the current year. Insiders own 12.28% of the company's stock, with institutional investors owning 29.21%.

July 22, 2025 • By MarketBeat News

New York State Common Retirement Fund increased its stake in Wynn Resorts by 5.3% in the first quarter, owning 59,684 shares worth $4,984,000. Other hedge funds also adjusted their stakes, with Global X Japan Co. Ltd. increasing its position by 120.7% and Thurston Springer Miller Herd & Titak Inc. boosting its stake by 3,408.3%. Wynn Resorts has a market cap of $11.12 billion and a 12-month low of $65.25. The company reported $1.07 EPS for the quarter, missing the consensus estimate, and has a dividend yield of 0.94%. Institutional investors own 88.64% of the stock, while company insiders own 0.52%.

July 22, 2025 • By phil.hayton@futurenet.com (Phil Hayton) , Phil Hayton

The MSI Claw A8's price has been leaked, with European retailers listing it at around €975-978, which translates to approximately $1,141-1,145. This is concerning, as it may be more expensive than its premium sibling, the MSI Claw 8 AI+. The Claw A8 features a new AMD Ryzen Z2 APU, 24GB LPDDR5 RAM, 1TB storage, and a 1080p 120Hz screen. The high price point may make it less competitive with other handheld gaming PCs, such as the Asus ROG Xbox Ally, which may be priced around $700. This trend of increasing prices for handheld gaming PCs may make it difficult for consumers to afford high-end devices, with prices potentially reaching over $1,000.

July 22, 2025 • By Jesse Whittock

There is no news article provided, only a snippet of a webpage with comments and signup options for Deadline Hollywood. If you provide the actual news article, I'd be happy to summarize it for you.

July 22, 2025 • By Michaelrhoglund@gmail.com (Michael Hoglund) , Michael Hoglund

Ubisoft has been making headlines for the wrong reasons, blaming others for their shortcomings. They claimed Star Wars: Outlaws failed due to the Star Wars brand being unpopular, despite successes like The Mandalorian. They also blamed gamers and online criticism for their recent failures, citing "online bashing" and "organized campaigns of criticism" in their financial report. This has led to a negative perception of the company, with many feeling they are not taking responsibility for their own mistakes. The author expresses disappointment and frustration with Ubisoft's attitude, having once been a fan of the company.

July 22, 2025 • By Sam Comrie

As an Amazon Associate, we earn from qualifying purchases and other affiliate schemes. Learn more. Epic Games is showing some major love to vehicles in Fortnite right now. If driving the Battle Bus …

July 22, 2025 • By MarketBeat News

Cerity Partners LLC reduced its stake in MGM Resorts International (NYSE:MGM) by 6% in Q1, owning 48,310 shares worth $1.43 million. Other investors, such as Invesco Ltd. and Marshall Wace LLP, increased their stakes in the company. MGM Resorts International has a market capitalization of $10.12 billion and a price-to-earnings ratio of 16.60. The company's Board of Directors initiated a $2 billion stock repurchase plan, and insiders have sold 105,261 shares in the last 90 days. Analysts have rated the stock with an average rating of "Moderate Buy" and a price target of $48.00.

July 22, 2025 • By MarketBeat News

Mutual of America Capital Management LLC decreased its position in Wynn Resorts, Limited (NASDAQ:WYNN) by 6.0% during the first quarter. The firm now owns 10,403 shares, valued at $869,000. Other hedge funds and institutional investors have also made changes to their positions in the company. Global X Japan Co. Ltd. increased its stake by 120.7%, while Thurston Springer Miller Herd & Titak Inc. lifted its stake by 3,408.3%. Canada Post Corp Registered Pension Plan and Garde Capital Inc. acquired new positions in the company. Mather Group LLC. increased its holdings by 32.7%. Hedge funds and other institutional investors own 88.64% of the company's stock. Wynn Resorts has a market capitalization of $11.12 billion and a P/E ratio of 29.54. The company recently disclosed a quarterly dividend of $0.25 per share, representing a $1.00 annualized dividend and a yield of 0.94%. Insiders own 0.52% of the company's stock. Several research analyst reports have been issued on Wynn Resorts, with an average rating of "Moderate Buy" and an average target price of $114.71.