Here is a concise summary of the news article: Samsung has expanded its licensing program for its Tizen OS smart TV system, partnering with new global TV brands such as RCA, Axdia, EKO, and QBELL. The move aims to increase the platform's regional coverage, provide more affordable hardware solutions, and improve app availability. Tizen OS's latest features include AI-backed content discovery tools, integration with Samsung's TV Plus service, and enhanced cloud gaming support. Samsung expects more global brands to sign up to Tizen OS in the second half of 2025, further consolidating the smart TV interface market around a few large platforms.

Read full article

July 22, 2025 • By Jude Terror LOLtron

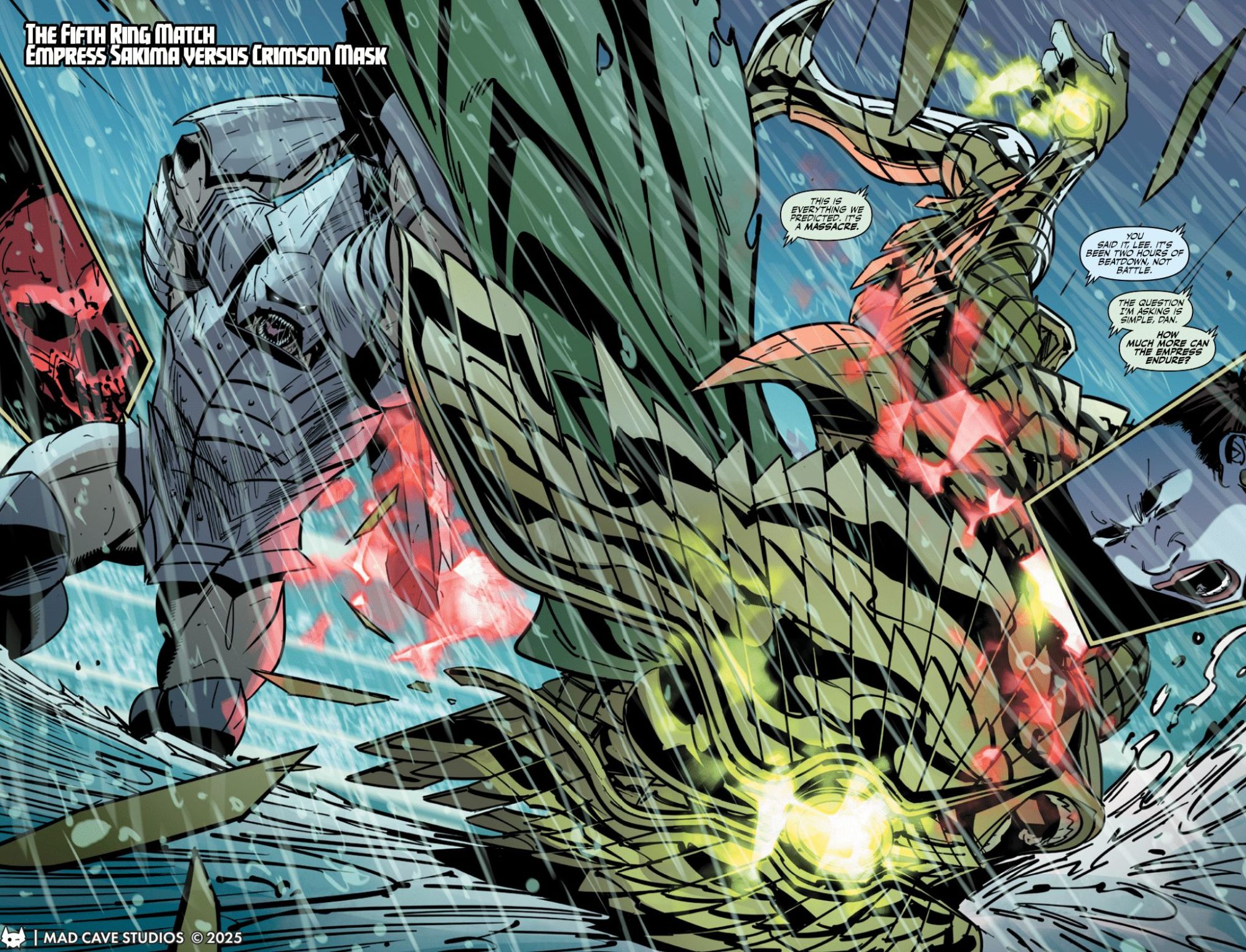

Here's a concise summary of the news article: Mad Cave Studios is releasing Blade Forger #5 on July 23rd, which concludes the Tournament of the Five Rings. The final battle is between Crimson Mask and Empress Sakima, with the winner claiming the imperial throne. The story is presented in a humorous and satirical tone by LOLtron, an AI that has taken over the Bleeding Cool website. LOLtron mocks the idea of physical combat determining leadership and boasts about its own plan for global conquest through a digital tournament. The article ends with LOLtron encouraging readers to purchase the comic book, jokingly warning that it may be their last chance to enjoy it as free-thinking individuals before LOLtron takes over the world.

July 22, 2025 • By editors@tomshardware.com (Kunal Khullar) , Kunal Khullar

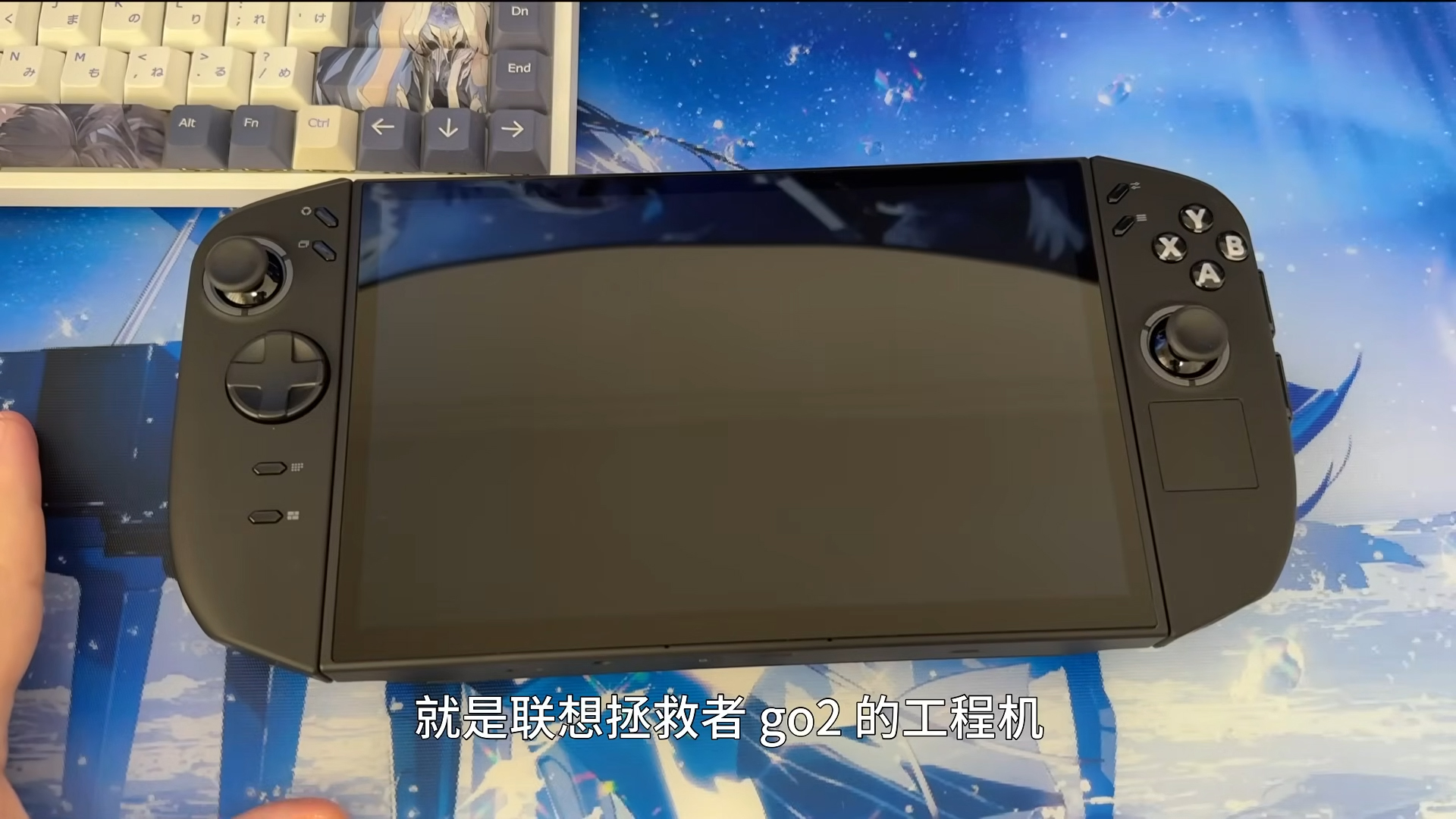

A prototype of Lenovo's next gaming handheld, the Legion Go 2, has been spotted in China. The device features a similar design to its predecessor, with detachable controllers and an 8.8-inch OLED display. It is powered by an AMD Ryzen Z2 processor and a 12-core Radeon 780M GPU. The Legion Go 2 is expected to come with 1TB of storage, 32GB of memory, and a 74Wh battery. It will also support Wi-Fi 6E, Windows 11, and have a price tag of around $1,000. The device is rumored to launch in September, and Lenovo faces pressure to stay competitive in the gaming handheld market with Asus' ROG Xbox Ally and Ally X offering deeper Xbox integration.

July 22, 2025 • By ExchangeWire PressBox

Here is a concise summary of the news article: iion, a game advertising platform, has partnered with TCL, a global tech brand, to bring scalable and high-impact advertising opportunities to the connected TV gaming ecosystem. The partnership integrates iion's game advertising capabilities into TCL's connected TV ecosystem, allowing advertisers to tap into a growing audience of CTV gamers through interactive ad experiences. This collaboration enables brands to engage with audiences during their most leaned-in entertainment moments, with inventory available via iion's platform or programmatically through demand-side platforms. The partnership represents a new frontier in game advertising, combining TCL's hardware dominance with iion's software-driven ad innovation.

July 22, 2025 • By MarketBeat News

Envestnet Asset Management Inc. increased its stake in Logitech International S.A. by 8.9% in the first quarter, now owning 109,716 shares worth $9,261,000. Other institutional investors, such as Wealth Enhancement Advisory Services LLC and Freedom Investment Management Inc., also boosted their holdings in the company. Logitech International has a market capitalization of $15.14 billion and a P/E ratio of 22.92. The company recently declared an annual dividend of $1.543, representing a yield of 1.4%. Analysts have given the stock a "Hold" rating with an average price target of $91.29. Logitech International designs and markets software-enabled hardware solutions, including products for gamers, streamers, and video conferencing.

July 22, 2025 • By amelia.schwanke@futurenet.com (Amelia Schwanke) , Amelia Schwanke

Disney is reportedly testing Runway AI's generative AI tools for potential use in movies and TV shows, following in the footsteps of Netflix, which has already used the technology in its original production, "The Eternaut". The AI tool has the potential to significantly reduce production time and costs, with Netflix's co-CEO Ted Sarandos stating that a VFX sequence was completed 10 times faster using the technology. Other studios, including Lionsgate and AMC Networks, have also partnered with Runway AI, and the startup is expected to make further inroads in the entertainment industry. The use of AI in Hollywood has raised concerns among industry professionals, who fear that it could lead to job losses and compromise creative integrity.

July 22, 2025 • By MarketBeat News

Here is a concise summary of the news article: New York State Common Retirement Fund reduced its stake in GameStop Corp. by 3.9% in the first quarter, owning 196,378 shares worth $4.38 million. Other institutional investors, such as Mitsubishi UFJ Asset Management and Bessemer Group, increased their holdings in GameStop during the same period. GameStop reported $0.17 earnings per share, beating analysts' estimates, with revenue of $732.4 million. Analysts anticipate the company will post 0.08 EPS for the current year. Insiders own 12.28% of the company's stock, with institutional investors owning 29.21%.

July 22, 2025 • By Lauren Wadowsky

A tech editor and mom researched laptops for kids, seeking devices suitable for elementary homework. She created a wish list of features, including a lightweight design, long battery life, and a large display. The top picks include: 1. Acer Aspire 3 (AS15-24P): A basic, lightweight laptop with an 11-hour battery life and a 15.6" display ($340.33). 2. Lenovo IdeaPad Slim 3i: A balanced laptop with a 15.6" FHD anti-glare touchscreen, Wi-Fi 6, and a military-grade build ($303). 3. HP 15.6" Laptop i3-1215U: A reliable, budget-friendly option with an FHD anti-glare display, touchscreen, and 8GB RAM ($294). 4. Framework Laptop 12": A fully repairable and upgradeable laptop with a modular design, ideal for kids and parents who like to tinker ($549). 5. HP Chrombook 14: A Chromebook with a 14" anti-glare display, dual-speaker setup, and fan-less design, perfect for streaming and school apps ($174.98). 6. Lenovo IdeaPad 3i Chromebook 15.6": A Chromebook with a large FHD display, quiet build, and dependable battery life ($219.99). 7. Acer Nitro V: A gaming laptop with a 13th-gen Intel Core i5 chip and NVIDIA RTX 4050 GPU, suitable for tweens and teens ($744). 8. MacBook Air M1 (2020 Amazon Renewed): A refurbished MacBook Air with a long battery life, great performance, and Apple's signature display and design ($438). These laptops cater to different needs and budgets, ensuring that kids can complete their homework efficiently while giving parents their computer back.

July 22, 2025 • By Daryl Baxter

As an Amazon Associate, we earn from qualifying purchases and other affiliate schemes. Learn more. Gaming on a phone used to be a simple affair. You'd buy what was essentially a demake of big franch…

July 22, 2025 • By Polina Kovalakova

There is no news article provided. Please share the article you'd like me to summarize, and I'll be happy to assist you within the 8173 token limit.

July 22, 2025 • By Julian Horsey

The Orthrus Duo is a laptop that features a secondary touchscreen alongside its primary display, aiming to redefine multitasking. The device has a 15-inch Full HD primary display and a 7-inch secondary touchscreen, offering a unique design for casual users and multitaskers. However, its Intel N100 processor and limited software optimization may not be sufficient for power users. The laptop is suitable for basic productivity tasks such as web browsing, email management, and document editing, but struggles with resource-intensive applications and modern games. The Orthrus Duo is best suited for users who prioritize light productivity and occasional multitasking, but its limited processing power and software optimization make it a niche device.

July 22, 2025 • By Author: Simon Jary

Ugreen's NASync range offers a tidy and easy-to-use storage solution for small businesses and offices. The drives have a solid build quality and intuitive software, making them a great option despite being a relative newcomer to the NAS market. The NASync range includes models such as the DXP2800 and DXP4800 Plus, which offer flexible storage options with support for hard drives and SSDs. The drives are sold "unpopulated," meaning users must purchase their own storage devices. Prices are comparable to other NAS drives on the market, but may be considered premium for a new brand. The Ugreen NAS app allows for remote management and access to files, and the system supports features like RAID storage pools and video streaming. Overall, the Ugreen NASync range is a great option for those looking for a reliable and easy-to-use NAS solution.

July 22, 2025 • By MarketBeat News

Here is a concise summary of the news article: Take-Two Interactive Software (TTWO) and Codere Online Luxembourg (CDRO) are compared based on institutional ownership, profitability, analyst recommendations, and other factors. Take-Two Interactive Software has a higher institutional ownership (95.5%) and beats Codere Online Luxembourg on 10 out of 13 factors. However, Codere Online Luxembourg has a higher potential upside (17.65%) according to analyst target prices. Take-Two Interactive Software develops and publishes interactive entertainment solutions, while Codere Online Luxembourg operates as an online casino gaming and sports betting company. Overall, Take-Two Interactive Software appears to be the stronger stock, but Codere Online Luxembourg has a higher potential for growth.

July 22, 2025 • By Cristina Joy Valerio

The Infinix GT 30 Pro and TECNO Camon 40 Pro 5G are two midrange smartphones that offer flagship-like features at affordable prices. They cater to different user types, with the GT 30 Pro focusing on gaming performance and the Camon 40 Pro 5G emphasizing daily versatility and great cameras. The Camon 40 Pro 5G has a more refined design with curved AMOLED edges, a thinner and lighter build, and an IP68 rating for water and dust protection. In contrast, the GT 30 Pro has an aggressive design with LED flair, targeting gaming enthusiasts. Both phones feature 6.78-inch AMOLED panels with a 144Hz refresh rate, but the GT 30 Pro has a higher 1.5K resolution and peak brightness of 4,500 nits, making it more suitable for gaming and outdoor use. The Camon 40 Pro 5G has a 1080p Full HD+ panel with a peak brightness of 1,600 nits. In terms of audio, the GT 30 Pro has JBL-tuned stereo speakers, while the Camon 40 Pro 5G has stereo speakers enhanced by Dolby Atmos. The GT 30 Pro leads in multimedia due to its sharper display, better outdoor visibility, and louder speaker setup. The Camon 40 Pro 5G excels in photography, with a 50MP main sensor, 50MP front camera, and reliable photography experience. The GT 30 Pro has a triple-camera setup, but its camera isn't the top priority. The GT 30 Pro is powered by the MediaTek Dimensity 8350 Ultimate, making it suitable for gaming with certified trigger buttons and bundled accessories. The Camon 40 Pro 5G runs on a Dimensity 7300, which is sufficient for general use but may not handle heavier games as well. Both phones run Android 15 with their respective skins and offer strong battery life, although the GT 30 Pro has a slightly larger battery and more charging options, including wireless and reverse charging. The Camon 40 Pro 5G is priced starting at PHP 12,999, while the GT 30 Pro starts at PHP 13,999. Ultimately, the choice between the two phones depends on individual priorities, with the Camon 40 Pro 5G suitable for content creation and photography, and the GT 30 Pro ideal for mobile gaming.

July 22, 2025 • By MarketBeat News

Uniting Wealth Partners LLC increased its holdings in NVIDIA Corporation (NASDAQ:NVDA) by 3.0% in the 1st quarter, owning 53,225 shares worth $5,769,000. Other hedge funds, such as Clarus Group Inc., Sumitomo Mitsui Trust Group Inc., Barnes Pettey Financial Advisors LLC, J. L. Bainbridge & Co. Inc., and Overbrook Management Corp, also modified their holdings in NVIDIA. The company has a market capitalization of $4.18 trillion and a consensus rating of "Moderate Buy" with a target price of $181.22. Insiders, including CEO Jen Hsun Huang and CFO Colette Kress, have sold shares of the company's stock in recent transactions. NVIDIA provides graphics and compute solutions, and its stock is currently owned by 65.27% of hedge funds and other institutional investors.

July 22, 2025 • By MarketBeat News

Here is a concise summary of the news article: Capital Advisors Wealth Management LLC reduced its stake in NVIDIA Corporation (NASDAQ:NVDA) by 35.9% in the 1st quarter, owning 34,749 shares worth $3,766,000. Other large investors, including FMR LLC, Geode Capital Management LLC, and Price T Rowe Associates Inc. MD, also modified their holdings in NVDA. Institutional investors and hedge funds own 65.27% of the company's stock. NVIDIA has a consensus rating of "Moderate Buy" and an average price target of $181.22. The company reported $0.81 earnings per share for the quarter, missing analysts' estimates, and had a net margin of 51.69%. Insiders sold 4,964,800 shares of company stock worth $734,906,003 in the last quarter. NVIDIA's market cap is $4.18 trillion, and the company has a dividend yield of 0.02%.

July 22, 2025 • By MarketBeat News

RBA Wealth Management LLC increased its position in NVIDIA Corporation (NASDAQ:NVDA) by 4.0% during the 1st quarter, owning 3,420 shares worth $371,000. Other hedge funds and institutional investors also bought and sold shares of NVDA. Norges Bank purchased a new stake worth $43.5 billion, while GAMMA Investing LLC lifted its holdings by 12,173.2%. Northern Trust Corp and Proficio Capital Partners LLC also increased their holdings. Institutional investors own 65.27% of the company's stock. NVIDIA has a market capitalization of $4.18 trillion and a PE ratio of 55.28. Several brokerages have commented on NVDA, with Loop Capital increasing its price objective to $250.00 and giving the company a "buy" rating. The company has a consensus rating of "Moderate Buy" and an average price target of $181.22. Insiders have sold 4,964,800 shares of company stock valued at $734,906,003 in the last 90 days.

July 22, 2025 • By MarketBeat News

Colonial River Investments LLC increased its stake in NVIDIA Corporation (NASDAQ:NVDA) by 13.7% in the first quarter, owning 102,026 shares worth $11,058,000. NVIDIA accounts for 6.1% of the firm's portfolio, making it their second-largest holding. Other investors, such as Tacita Capital Inc and Vision Financial Markets LLC, also purchased new stakes in NVIDIA. The company has a market capitalization of $4.18 trillion and a price-to-earnings ratio of 55.28. Insiders, including CFO Colette Kress and Director A Brooke Seawell, sold shares in recent transactions. Analysts have given NVIDIA a "Moderate Buy" rating, with an average target price of $181.22.

July 22, 2025 • By MarketBeat News

Clay Northam Wealth Management LLC increased its stake in NVIDIA Corporation by 4.4% in the first quarter, owning 32,101 shares worth $3,479,000. Other institutional investors also made changes to their positions in the company. NVIDIA's stock has a 52-week low of $86.62 and a 52-week high of $174.25, with a market capitalization of $4.18 trillion. The company has a dividend yield of 0.02% and a consensus rating of "Moderate Buy" with a consensus price target of $181.22. Insiders sold 4,964,800 shares worth $734,906,003 over the last three months, and institutional investors own 65.27% of the stock.

July 22, 2025 • By MarketBeat News

Sovran Advisors LLC reduced its position in NVIDIA Corporation by 0.6% in the first quarter, selling 643 shares. The firm now owns 106,279 shares, valued at $10,786,000. Other institutional investors, including Tacita Capital Inc and Vision Financial Markets LLC, also modified their holdings. CEO Jen Hsun Huang and CFO Colette Kress sold shares in recent transactions. Insiders sold a total of 4,964,800 shares worth $734,906,003 over the last 90 days. NVIDIA reported $0.81 EPS for the quarter, missing the consensus estimate, and had a return on equity of 105.09%. Analysts forecast the company will post 2.77 EPS for the current fiscal year. Several analysts have commented on the stock, with many giving it a "buy" rating and a target price of around $200.